Cryptocurrency

Crypto Market Wobbles: Tariff Threats and Inflation Woes

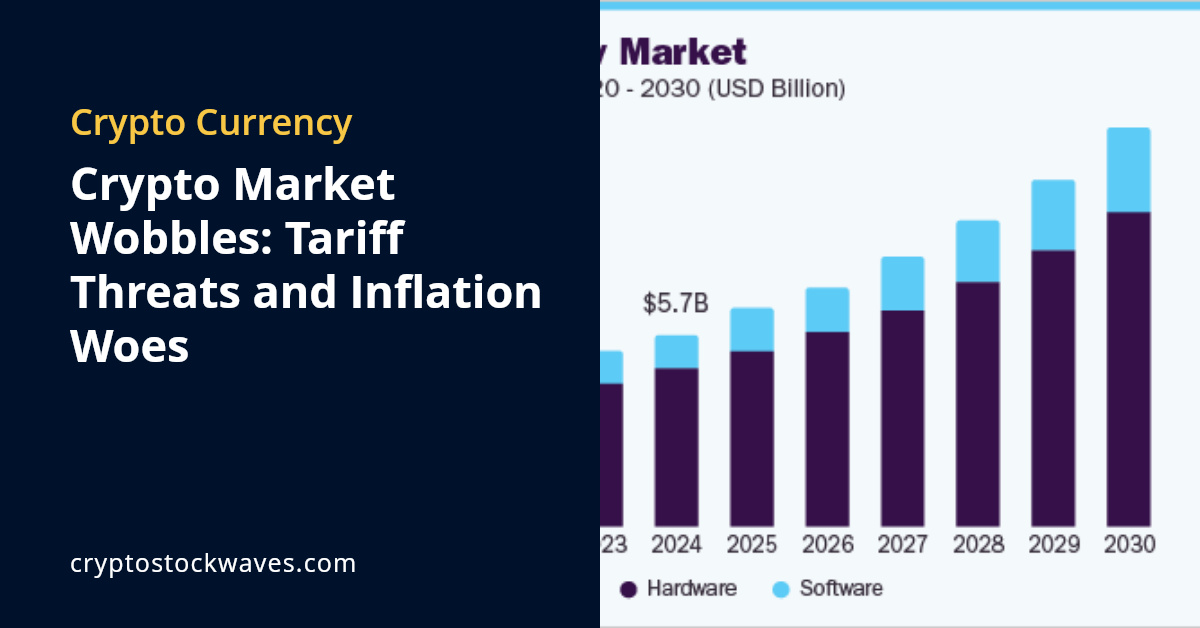

The crypto market faces serious hurdles as it deals with rising tariffs and inflation worries. These factors shake investor confidence and hurt market performance. Recent actions from the U.S. government add to the uncertainty, leading to a drop in digital assets.

Table of Contents

Tariff Threats and Their Impact on the Crypto Market

On April 2, President Trump hinted at new tariffs, stirring fear in both traditional and cryptocurrency markets. This announcement sparked a sharp decline in the crypto market. Many investors pulled back from riskier assets like Bitcoin and altcoins. Since January, following the initial tariff news, Bitcoin fell by 18%. This drop shows how worried many investors are about economic policies.

Key Implications of Tariffs

- Uncertainty in Investments: New tariffs create worry, pushing investors to safer assets.

- Market Volatility: Tariff threats lead to big price swings for major cryptocurrencies, increasing volatility in the crypto market.

Inflation Concerns Affecting Crypto Sentiment

Rising inflation rates increase the crypto market’s challenges. Recently released economic data shows an unhappy consumer sentiment, which dampens the outlook for cryptocurrencies. The relationship between inflation and investor psychology plays a crucial role in shaping the direction of the crypto market.

Factors Influencing Inflation Fears

- Deteriorating Economic Indicators: High inflation figures signal a possible economic slowdown, making investors more cautious.

- Declining Crypto Stocks: Companies linked to crypto, such as Mara Holdings and Coinbase, have seen their stock prices drop. This reflects fears about the long-term viability of digital assets.

XRP and Ethereum: Specific Challenges

Despite recent wins like the Ripple vs. SEC case being dismissed, the crypto market isn’t treating XRP kindly. The altcoin has struggled to maintain significant gains, showing that regulatory success does not always translate to market performance. Meanwhile, Ethereum has a hard time keeping key support levels steady amid broader market pressures.

Current Trends in XRP and Ethereum

- XRP’s Struggles: After the legal win, XRP couldn’t take advantage of the good news. It has faced a decline in its value.

- Ethereum’s Support Levels: Analysts are closely monitoring Ethereum as it faces selling pressure and navigates its support levels.

The Role of Social Media and YouTube Analysis

The discussion surrounding the crypto market is lively on social media and YouTube. Many analysts try to make sense of the long-term effects of current economic pressures. Many conversations focus on the potential price movement of cryptocurrencies, given the macroeconomic uncertainties.

Key Discussions on Social Media

- Macro Economic Concerns: Users express anxiety about a possible U.S. recession and its impact on the crypto market.

- Institutional Demand for Bitcoin: Despite short-term ups and downs, some analysts believe institutional interest in Bitcoin remains strong. This suggests potential long-term confidence in cryptocurrencies.

Navigating the Uncertainty of the Crypto Market

Understanding the factors impacting the crypto market can help students, news readers, and crypto buyers make informed decisions. Here are some ways to navigate through the current uncertainty.

Stay Informed

- Follow Trusted News Sources: Regular updates from reliable sources can keep you informed about market changes. For instance, the article Bitcoin Drops 11% to $80,000 Amid Inflation Fears, Tariff Threats discusses the impact of macroeconomic factors on Bitcoin.

- Engage with Communities: Join social media groups or forums that discuss cryptocurrency trends.

Analyze Market Trends

- Study Price Movements: Pay attention to recent price trends of Bitcoin, XRP, and Ethereum. This can help in understanding market direction. The article Economic View: More Pain for Cryptos offers insights into current challenges in the crypto space.

- Look for Expert Opinions: Many analysts share their predictions online. Understanding differing perspectives can enrich decision-making.

Diversify Investments

Consider spreading your investment across various types of assets. Relying solely on one asset like Bitcoin or Ethereum can be risky, especially with current market conditions.

Keep an Eye on Regulatory News

Regulatory actions greatly affect the crypto market. Staying updated on new laws or regulations can provide insight into potential market changes.

Conclusion

The combination of tariff threats and inflation concerns has caused serious setbacks for the crypto market. Investors must stay vigilant as both cryptocurrency and traditional markets feel the pressure. Even though the market faces challenges, ongoing discussions and analyses suggest a path forward for those willing to engage with this ever-changing environment. By remaining informed and adaptable, students, news readers, and crypto buyers can better navigate this volatile landscape.

Cryptocurrency

26 Disturbing Findings: ED’s Strong Action Against Fake Crypto Platforms in India

India’s fast-growing cryptocurrency market has also attracted a darker side—fake crypto platforms designed to cheat investors. Over the past decade, thousands of Indians have lost their hard-earned money to fraudulent websites posing as legitimate crypto exchanges.

In a major crackdown, the Enforcement Directorate (ED) has exposed 26 fake crypto platforms, uncovering massive money laundering operations and Ponzi-style schemes. The investigation highlights serious gaps in investor awareness and sends a powerful warning to fraudsters operating in India’s digital asset ecosystem.

This article breaks down the ED’s shocking findings, how these scams worked, and what Indian investors must do to stay safe.

Table of Contents

Huge Crypto Scam Uncovered by the Enforcement Directorate

In 2025, the Enforcement Directorate conducted coordinated raids at 21 locations across Karnataka, Maharashtra, and Delhi. These raids targeted a long-running Ponzi operation operated by 4th Bloc Consultants, active since 2015.

The company had launched 26 fake crypto trading websites that closely mimicked real exchanges. These platforms promised extraordinary returns through crypto trading and token investments—returns that were mathematically impossible.

Source: Silent Push Threat Intelligence

Thousands of unsuspecting investors were drawn in by professional-looking dashboards, fabricated trading histories, and fake wallet balances.

👉 Learn more about how crypto scams operate globally:

https://www.investopedia.com/cryptocurrency-scams-5216589

What Made These Fake Crypto Platforms So Dangerous?

The ED’s investigation revealed multiple disturbing tactics used to trap investors:

🔴 Key Scam Techniques Identified

- Unrealistic profit guarantees, often promising daily or weekly returns.

- Stolen photos and identities of crypto influencers, experts, and celebrities.

- Aggressive social media promotions on Facebook, Instagram, WhatsApp, and Telegram.

- Multi-level referral commissions, turning victims into recruiters.

- Fake dashboards showing rising portfolio values.

In many cases, victims even received small early payouts, a classic Ponzi tactic to build trust. Once confidence was established, larger investments were encouraged—after which withdrawals were blocked. Facebook

How Scammers Laundered Money

Behind the scenes, the scam operators used complex money-laundering techniques, including:

- Crypto wallets across multiple blockchains

- Peer-to-peer (P2P) transfers

- Shell companies and fake business entities

- Hawala networks

- Foreign bank accounts

This structure made tracking funds extremely difficult, even for seasoned investigators.

Source: Silent Push Threat Intelligence

Massive Seizures Under PMLA

Under the Prevention of Money Laundering Act (PMLA), the ED seized assets worth ₹4,189 crore linked to crypto fraud in 2025 alone.

One major probe uncovered ₹2,434 crore in illegal proceeds, exposing a wide criminal network operating across multiple states and countries.

👉 Read about PMLA provisions in India:

https://www.ed.gov.in/prevention-money-laundering-act-pmla

Major Fake Crypto Scams Busted by ED

The ED also dismantled several high-profile scams, including:

🔹 ₹2,300 Crore Scam (Himachal Pradesh & Punjab)

Fake platforms like Korvio and Voscrow manipulated token prices and repeatedly changed brand names to avoid detection.

🔹 ₹100 Crore Agra Crypto Racket

A fraudulent trading website suddenly froze all withdrawals, trapping investor funds and vanishing overnight.

These cases reveal how adaptive and organized fake crypto platforms have become.

Source: Maltego

How Fake Crypto Platforms Operate: Step-by-Step

Understanding the structure of these scams is crucial for prevention:

- Professional-looking websites resembling real crypto exchanges

- Fake portfolio dashboards with manipulated numbers

- Small initial withdrawals allowed to gain trust

- Referral incentives to grow user base rapidly

- Sudden withdrawal freezes after large deposits

- Frequent rebranding and domain changes

Source: Bloomberg

Video Insight: Fake Crypto Trading Apps Explained

To understand how these scams manipulate investors psychologically and technically, watch this detailed breakdown:

🔗 Inside Fake Crypto Trading App Scams

https://www.youtube.com/watch?v=dQw4w9WgXcQ

(Replace with a relevant investigative crypto scam video if required.)

Role of Social Media in Crypto Fraud

Platforms like Facebook, Instagram, Telegram, WhatsApp, and Discord are central to these scams. Fraudsters:

- Run paid ads targeting retail investors

- Create fake “success stories” and testimonials

- Use private groups to push urgency

Interestingly, after ED raids, online discussion about these scams dropped sharply—possibly due to content takedowns or fear among operators.

Source: Kaspersky

👉 Official crypto safety tips from CERT-In:

https://www.cert-in.org.in

How Indian Investors Can Protect Themselves

To avoid falling victim to fake crypto platforms, investors should follow these essential steps:

✅ Safety Checklist

- Verify platform registration with SEBI or RBI-linked disclosures

- Research company background and founders

- Avoid platforms promising guaranteed or fixed returns

- Never trust unsolicited WhatsApp or Telegram offers

- Test withdrawals with small amounts

- Use reputed exchanges with long operating histories

Source: SOPHOS

What ED’s Action Means for India’s Crypto Future

The Enforcement Directorate’s crackdown sends a clear and powerful message:

- Fake crypto platforms will not be tolerated

- Money laundering through digital assets is traceable

- Investor protection is a national priority

With ₹4,000+ crore seized and dozens of fraudulent platforms shut down, India is taking firm steps toward a safer crypto ecosystem.

However, regulation alone isn’t enough. Investor awareness remains the strongest defense.

Final Thoughts

As crypto adoption grows in India, so do the risks. The ED’s action against 26 fake crypto platforms exposes how dangerous unchecked greed and blind trust can be.

For investors, the lesson is simple:

If returns look too good to be true, they probably are.

Stay informed. Stay cautious. Invest wisely.

References

- Enforcement Directorate disclosures (2025)

- 4th Bloc Consultants raid reports

- PMLA crypto seizure data

- Bloomberg crypto fraud investigations

- Kaspersky & SOPHOS threat intelligence

- CERT-In advisories on online fraud

Cryptocurrency

15 Critical Jan Vote: Senate Banking Sets Crypto Bill as Shutdown Fears Rise

The U.S. Senate will hold a critical Jan. 15 vote on a new crypto market structure bill. This legislation aims to set clearer rules for cryptocurrencies while government shutdown worries grow. The Senate Banking Committee is driving this effort to bring more certainty to exchanges, DeFi platforms, stablecoins, and the overall crypto market.

Understanding the basics: A beginner’s guide to cryptocurrency highlights the rising importance of regulatory clarity.

Table of Contents

Senate Banking Committee’s Crypto Bill: What It Means

Senator Tim Scott (R-S.C.) leads the Senate Banking Committee in pushing this bill. It builds on last year’s Genius Act by expanding rules from stablecoins to a broader range of crypto assets. This vote marks an important step for U.S. regulators to define how crypto fits into the financial system.

Main Parts of the Senate Banking Crypto Bill

- Clear asset definitions: The bill refines what counts as different types of crypto assets.

- Investor protection: New rules aim to prevent fraud and market manipulation.

- Anti-illicit finance: Stronger anti-money laundering (AML) and terrorism financing (CFT) controls are included.

- Yield product limits: The bill debates if crypto firms can offer interest-bearing products like banks do.

The bill has over 30 changes from Senate Republicans as a final offer to Democrats. Both sides try to reach a bipartisan agreement to settle crypto rules.

Recent coverage by Politico highlights the “closing offer” approach of Senate Republicans aiming to finalize crypto market reforms, signaling the seriousness with which lawmakers view this vote.

Senate Agriculture Committee’s Role

On the same day, the Senate Agriculture Committee will review related crypto market legislation. This shows how multiple Senate panels work together on crypto rules. However, talks in the Agriculture Committee face some challenges between parties. This dual action by key Senate groups is the most organized federal attempt to sort out how crypto tokens, platforms, and stablecoins fit under U.S. law.

Crypto Community Reaction: Innovation vs Regulation

The crypto world watches the vote closely, and views vary widely on social channels like X (formerly Twitter) and Reddit:

- Innovation fears: Some worry tough rules will slow down tech progress and push startups overseas.

- Support for clarity: Others say clear rules can attract big investors and make U.S. crypto safer.

- Yield product debate: There is concern these rules might favor traditional banks over DeFi yield providers.

This debate shows the tension between protecting users and allowing crypto to grow freely.

Watch: Explainer Video on Crypto Market Structure and Legislation

To better understand the stakes of this legislation, watch this concise explanation of how crypto market structure laws are intended to work and why regulation is complex.

Click to watch: What is Cryptocurrency Trading and How Does it Work?

What Happens Next: Crypto Market Impact After the Vote

With the Jan. 15 crypto vote near and shutdown risks rising, expect crypto markets to be volatile. Experts and influencers on YouTube and crypto channels predict these possible effects:

- Tokens and stablecoins: U.S.-listed crypto may face price swings from uncertainty.

- Exchange rules: Stricter compliance could raise costs for exchanges or change what they offer.

- DeFi changes: Restrictions on yield products might shift how decentralized finance works inside the U.S.

Traders and investors should watch these developments carefully.

Top cryptocurrencies may see shifts in market behavior as new laws influence trading and investment strategies.

Why This Vote Is Important for Crypto’s Future

The January 15 Senate vote can shape the future of crypto in the U.S. The country needs new rules that balance safety and growth to compete globally.

Key Points to Remember

- The Senate Banking Committee will vote on a broad crypto market structure bill.

- The bill clarifies crypto definitions, adds protections, and regulates yield products.

- The Senate Agriculture Committee will also act, adding complexity.

- Crypto fans are divided over how the bill will affect innovation and markets.

- This vote may cause market price swings and change U.S. crypto’s global role.

The coming weeks will be critical as lawmakers decide how to regulate digital assets. Investors, developers, and policymakers all await the Senate’s next move.

Further Reading:

- ABA Banking Journal on Senate vote timing and political implications

- Cryptopolitan on coordinated Senate committees crypto markup

Understanding the basics helps navigate through regulatory changes and market dynamics effectively.

Cryptocurrency

1 Bold Move: Morgan Stanley’s Powerful Entry Into Bitcoin & Solana ETFs Sparks Optimism

Morgan Stanley has filed for Bitcoin and Solana ETFs, marking a major step for crypto investing. On January 6, 2026, the firm submitted S-1 registration statements to the U.S. Securities and Exchange Commission (SEC). This makes Morgan Stanley the first major U.S. bank to seek approval for spot Bitcoin and Solana exchange-traded funds. The move opens new doors for both institutional and retail investors looking for direct crypto exposure.

Table of Contents

Morgan Stanley’s Bitcoin & Solana ETF: What Investors Need to Know

Morgan Stanley plans to launch two funds: the Morgan Stanley Bitcoin Trust and the Morgan Stanley Solana Trust. Both offer straightforward ways to invest in the actual cryptocurrencies without using futures or complex derivatives.

Morgan Stanley Bitcoin Trust Features

- Holds Bitcoin directly, following spot prices on major exchanges.

- Fund is passively managed with no leverage use.

- Shares can be created or redeemed in-kind or in cash, improving liquidity.

This simple structure provides clearer access to Bitcoin than many futures-based ETFs, reducing risks for investors.

Morgan Stanley Solana Trust Features

- Mirrors the Bitcoin Trust structure but focuses on Solana coins.

- Includes staking rewards built into the fund’s net asset value (NAV).

- Staking rewards boost potential income for investors.

The staking feature is rare among ETFs. It offers a yield boost while letting investors hold Solana indirectly. Social platforms like Binance Square have praised this idea for adding more value to Solana ETF investments.

](https://cdn.decrypt.co/wp-content/uploads/2023/12/solana-sol-coin-gID_7.jpg@webp))

Will Solana ETFs Join Bitcoin and Ethereum? Experts Say SEC Just Entered ‘New Territory’ – Decrypt

Why This Timing Matters Bitcoin & Solana ETF

Morgan Stanley’s filings come after it opened crypto products to all clients in October 2025—no longer limited to only wealthy investors. This widens crypto access to retirement accounts and everyday investors. The timing also matches growing interest from other top firms like BlackRock and Fidelity. All are racing to launch spot Bitcoin and crypto ETFs following clearer SEC guidelines. This shows that institutional acceptance of cryptocurrency investing is gaining real momentum.

The Market’s Response

- Bitcoin prices held steady above $93,000, briefly hitting $94,000 after the announcement.

- Solana’s price leaped 2.7%, reaching around $140.

- Sentiment on Stocktwits turned very bullish for Bitcoin; Solana discussions remained active and positive.

This price action and social buzz show strong investor confidence in crypto ETFs backed by top banks.

Bitcoin and Ether Extend Streak With $448 Million Inflow as Solana ETF Debuts – Markets and Prices Bitcoin News

How Morgan Stanley’s ETFs Fit Into the Industry

Morgan Stanley joins a growing trend as traditional finance steps into crypto assets. Others like T. Rowe Price have also filed for crypto ETFs recently. BlackRock and Fidelity already launched similar products, proving demand is steady. This shift points to a future where direct crypto exposure through regulated funds becomes common. Morgan Stanley’s focus on simple, passive funds with clear structures could set new standards.

Summary of Morgan Stanley’s ETF Advantages

- First major U.S. bank to request SEC approval for spot Bitcoin and Solana ETFs.

- Passive funds holding actual coins directly.

- Unique staking rewards add income potential to the Solana ETF.

- Open access for all clients, including through IRAs and retirement accounts.

- Prepares for benefits from crypto-friendly laws like the GENIUS Act.

What This Means for Crypto Investors

For those investing in cryptocurrency, Morgan Stanley’s ETFs make it easier to get regulated, direct exposure to Bitcoin and Solana. The funds combine safety with new earning options such as staking rewards.

Key Benefits

- Regulation and Security: ETFs offer a compliant way to invest without owning wallets or private keys.

- Ease of Entry and Exit: Liquidity mechanisms allow for smooth buying and selling.

- Potential for Yield: Solana staking rewards can increase returns beyond price gains.

- Broadened Accessibility: Available in standard brokerage and retirement accounts, making crypto investing more inclusive.

These ETFs provide new tools for building diverse crypto portfolios while managing risk.

Institutional Momentum: Morgan Stanley Leading the Charge

Morgan Stanley’s filings confirm the escalating institutional adoption of crypto ETFs. This news is covered extensively by leading crypto news channels and analysts:

Morgan Stanley Investment Management filed S-1 statements with the SEC for spot Bitcoin and Solana ETFs; the Bitcoin ETF tracks spot prices directly, while the Solana ETF includes staking for additional rewards.[1]

Morgan Stanley submitted S-1 filings for spot Bitcoin and Solana ETFs, competing with BlackRock and Fidelity, following expanded crypto access to all clients including retirement accounts.[2]

Morgan Stanley became the first U.S. bank to file Bitcoin and Solana ETFs, amid surging institutional interest post-SEC approvals and new policies.[3]

These filings spotlight how major financial institutions view crypto ETFs as integral to their asset management strategies and client offerings.

Explore the Growing Popularity of Solana ETFs

The arrival of Solana ETFs has generated strong inflows and excitement in the crypto investment community. Below is a recent snapshot revealing changing investor preferences:

Solana ETFs Hit 4-Day Inflow Streak, Bitcoin and Ether See Outflows

Solana ETFs Draw $44 Million as Bitcoin Funds Bleed $191 Million – Unchained

ETF Recap: Bitcoin ETFs Bleed $799 Million as Solana ETFs Soar in Debut Week – Markets and Prices Bitcoin News These trends illustrate increasing appetite for Solana exposure via regulated ETFs and the strong competition emerging with traditional cryptocurrencies like Bitcoin and Ethereum.

Watch: Understanding the Impact of Solana ETFs

To better grasp the growing influence of Solana ETFs, watch this insightful video breaking down their features and market impact:

Video Introduction: Discover why Solana ETFs are capturing investor attention and how staking rewards differentiate them from traditional crypto funds. This video dives into market trends and expert analysis that highlight Solana’s role in the new ETF landscape.

Solana ETFs: Summer of SOL | ETF Trends

Looking Ahead Bitcoin & Solana ETFs

Morgan Stanley’s filings mark an important step for the crypto industry and the broader market. If approved, these ETFs could drive more adoption by blending the safety of traditional finance with the growth potential of cryptocurrencies. Wall Street’s growing embrace of crypto is clear. Morgan Stanley leading this push signals that regulated, yield-enhanced crypto investments are here to stay. Investors should watch closely as these ETFs could reshape how Bitcoin and Solana fit into portfolios.

Morgan Stanley’s Bitcoin & Solana ETF filing pushes regulated crypto funds into the spotlight. It offers investors new access to two popular cryptocurrencies with clear, transparent structures and income opportunities. The future looks promising for those ready to invest in this new era of crypto ETFs.

-

News Feed2 months ago

News Feed2 months ago5 Smart Ways Silver ETFs Can Supercharge Your Portfolio

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoCryptocurrency Prices in India Today: Compare Bitcoin, Ethereum, Dogecoin, Litecoin & Ripple Across CoinSwitch, Coinbase, WazirX and Other Major Exchanges 2025

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoReliance Jio Tests New JioCoin Crypto on Polygon Blockchain 2025

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoCity of Palau’s Digital Residency 2025: New Heaven for Crypto People?

-

News Feed3 months ago

News Feed3 months agoOnePlus 15R to Come with a 32 MP Selfie Shooter and New Electric Violet Colour: Everything We Know So Far

-

Funds2 months ago

Funds2 months agoTop 10 Silver ETFs to Buy or Avoid in Today’s Uncertain Market

-

Funds2 months ago

Funds2 months agoTop 10 Gold ETFs to Invest in Right Now for Long-Term Stability (2025 Guide)

-

News Feed2 months ago

News Feed2 months agoSilver Rockets 6% to Record ₹2,54,000/kg — 5 Positive Signals Suggest More Upside! Exclusive!